Revisiting Bork the Antitrust Warrior

Some books change the world, they say, and that is even true for competition law and policy. This summer, Bertold Bär-Bouyssière re-read the one book that gave antitrust policy a new direction: Robert Bork’s “The Antitrust Paradox”. Here is his review!

Robert Bork´s seminal work “The Antitrust Paradox” is available again, published by Bork Publishing in 2021 with a new introduction by Senator Mike Lee and a Foreword by Robert H. Bork, Jr. The hardcover edition is at USD 39,99, it is quite a solid brick. The legacy subtitle of the Antitrust Paradox is “A Policy at War With Itself”. A new sub-subtitle explains: “The most important book on antitrust ever written”. A bit like “the greatest rock´n´roll band of the world” right off Mick Jagger´s thick red tongue.

Before writing this contribution for @Professor Rupprecht Podszun´s blog – an invitation that I am most privileged to receive and grateful to accept – I read the book again, at least the Chapters 1 to 8 included. My only criticism of the book as a physical product is the small pale print of the indented citations, which I find difficult to read. The content, though, remains explosive, although with a caveat. I apologize for any misunderstandings of this great work and thank my antitrust buddies @Steven Levitsky and @Todd Seelman for a brief collegial peer review.

In the Age of Innocence

Some books are like meteorites: They have a lasting impact. The Antitrust Paradox is one of them.

I grew up intellectually with the editorials of the Frankfurter Allgemeine Zeitung, which praised the merits of the free enterprise system and condemned the evils of price regulation or any government interference with entrepreneurial freedom. Like many insecure teenagers in the 1970s, I flirted with the left. Sartre was sexier than Ludwig Erhard.

Questions of right or wrong, of right or left, left being wrong, were the subject of daily heated debates in the classroom. These were the days when people still had opinions, and quite principled ones. Admittedly, there were opinions to be had.

According to the Frankfurter Allgemeine, leftism was fluffy ideology, whereas true capitalism was experience-based, the real stuff. Inexperienced nerds like myself preferred ideology to facts because ideology explained the whole world in one point and we could not interpret the facts, even if we knew any. The word “theory” was hot, and many prolific writers who published their works in Edition Suhrkamp were disciples of Hegel and Marx – they valued dialectics over facts.

At Freiburg University, in the seminar of Professor Joseph H. Kaiser (the estate administrator of Carl Schmitt), I came across Karl Schiller´s “Globalsteuerung”. Schiller (a social democrat), federal minister for economy & finance under Chancellor Georg Kiesinger in the 1960s, had developed a complex system of economic policy based on coordinated planning and the fine-tuning of all macroeconomic policies. Called “Globalsteuerung” in German and “Concerted activity” by Wikipedia, it was closer to French-style planning than to Soviet-type planning, but it was still government planning. The Globalsteuerung was fascinating, both as concept and policy instrument, except that it did not work in practice. I use the opportunity to pay dues to @Ingo Brinker, then an assistant of Professor Kaiser. He got me my first “hiwi” job as a student assistant, which was crucial to securing a Fulbright grant for an LL.M. at GW Law in Washington, D.C. a few years later. It was there that I would meet the Antitrust Paradox (which eventually inspired my doctoral thesis on “The Protectionist Dimension of US Merger Control”, supervised by two great mentors to whom I am profoundly indebted, Professor Jürgen Schwarze and the late Professor Werner von Simson).

At GW Law, Professor Thomas D. Morgan was a mild representative of the Chicago School, the attribute mild meaning that he would muse with subtle irony about the many errors of the Industrial Organization School and the uniformed judiciary; he was not a scornful ideologist. Professor Morgan recommended Bork and Posner. I read both but I only got hooked on Bork. Like Schiller´s Globalsteuerung, the Antitrust Paradox dealt with the burning penultimate economic policy issue of government interference with enterprise, but it did so unexpectedly, as mere theory. Everything was – or seemed – utterly simple and straightforward.

First, as a matter of sound economics the only legitimate goal of antitrust is, according to Bork, the maximization of consumer welfare (which I wrongly understood to mean my wallet in the sense of my wallet). Even thinking about any other policy goal was heresy, prone to undermine the economic outcome and pervert the judicial process. The legislature, not courts, should deal with all other policy goals. Sustainability was not yet a concern. Admittedly, in those days agencies used externalities against free enterprise decisions, rather than admitting them as a justification. Second, luck had it that Congress had clearly albeit subconsciously enshrined exactly that exclusive consumer welfare principle in the Sherman Act.

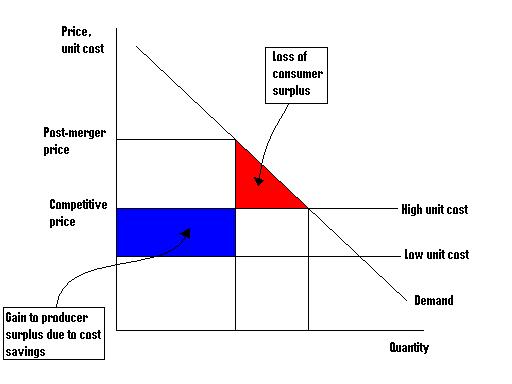

As a student with no practical business experience I took great relief from the fact that Oliver Williamson´s straightforward graph of the trade-off problem in a merger, now on page 107 of the Antitrust Paradox and reproduced below, “can be used to illustrate all antitrust problems” (page 108), like the world formula in Goethe´s Faust. Further, I did not need to understand the intricacies of “price theory”. It was a principle that could and should be trusted blindly, almost. The same applied to efficiencies: there should be no efficiency defense, as efficiencies are not quantifiable in a litigation setting. Courts should presume efficiencies to exist.

Antitrust thus should wholly rest on the tenets of “price theory”, meaning the concepts of microeconomics developed by Friedman and others (Friedman was a follower of Ayn Rand´s “objectivism”, a very libertarian – not libertine – school of thought). Concepts that, as Bork concedes, cannot be measured and play no role in corporate decision-making. What struck me most during my second read is that the Antitrust Paradox does not say much about price theory, notwithstanding its central role in the construct. Maybe there is not much to say except that “entrepreneurs act as if they were to maximize profits”. Reassures Bork:

“It makes some people uneasy to have to rely entirely upon theory to infer the nature of a reality that is not directly observed. Yet I am convinced both that the theory is good enough to make the task doable and, equally important, that there is no other possible way to proceed”.

(= the “Philo Vance approach to antitrust”, page 124)

Theory again, but this time on the “right” side of the political spectrum!

Paradise Not Lost

When reading the Antitrust Paradox as a student, the concept of allocative efficiencies mesmerized me most. Today I sense that Bork´s real fetish were the productive efficiencies. Looking again at the Williamson graph on page 107 (the one which covers all antitrust problems), “it illustrates so clearly the relationship between allocative and productive efficiencies in determining consumer wealth” (page 109). The model “addresses the total welfare of consumers as a class. It says nothing of how shares of consumption should be allocated through changes in the distribution of income.” In clear: Antitrust should only intervene where the dead-weight loss is greater than the cost savings (the two grey areas in the graph). This view has profound implications, which, as you will immediately understand, are most relevant today.

In the Williamson graph on page 107, the dead-weight loss (A1) is the grey shaded triangle below the demand curve. According to Bork, antitrust as an administrative and judicial process should only intervene where this area is, or should be presumed to be, larger than the grey shaded horizontal rectangle reflecting cost savings (A2). However, above that rectangle and left of the triangle there is a big unshaded square (P1-P2-Q0-Q2; in the copyright-free picture used here it is the white square between the red and blue fields). This square represents the loss of consumer surplus in a situation where a monopolist causes consumers to pay a higher price for lesser output. The loss of consumer surplus corresponds to the gain in monopoly profits. According to Bork, the owners of the monopoly are also consumers, and therefore the loss of consumer surplus merely reflects a shift in income between two classes of consumers (page 110). In other words, there is no loss of total consumer welfare and thus no reason for antitrust intervention – the legislature, not the courts, should address income distribution concerns, if any.

This goes in hand with my impression that Bork´s only concern with anticompetitive conduct are output restrictions rather than price increases (e.g., page 123). However, not even every conduct leading to an output restriction calls for a prohibition, because it can still create efficiencies (so-called mixed cases). In fact, there is very little in Bork´s view that calls for antitrust remedies at all.

Most importantly, monopoly or oligopoly resulting from internal growth should not be an antitrust concern at all (Chapter 8). There is no such thing as “unreasonable market power” (Donald F. Turner), as successful internal growth can only be the result of productive efficiencies. Success is the living proof of productive efficiencies. Breaking-up monopolistic firms would inevitably destroy these organically grown productive efficiencies, and that is not something antitrust should do. The same reasoning applies a fortiori to oligopolies. Bork considers the theory of tacit collusion to be foolish: if formalized cartels are so frequently instable due to cheating, how can tacit collusion, i.e., uncoordinated parallel conduct, be more effective in eliminating competition. This is definitively worth reflecting on today.

A Scholar at War

The Antitrust Paradox is a highly stimulating book, and antitrust peer @Raphael Fleischer posted rightfully on LinkedIn that “my annual date with Bob keeps impacting me every time. Useful to keep the mind sharp.” It is as refreshing as a spoonful of Wasabi, literally mind-blowing. Nevertheless, I cannot get rid of a suspicion that there is a missing link in Bork´s reasoning, which I struggle identifying. Note that some of the most influential books have that flaw. Hegel´s “Phenomenology of the Spirit” promises a path to absolute knowledge but then implodes in the final chapters on the verge of climax. And was it not Raymond Aron who wrote that the only reason why Marx never finished the “Capital” was that he had maneuvered himself into an intellectual dead-end street from which there was no escape? Life has taught me to be skeptical of high-flung literary promises, but I do enjoy a brilliant read. It is important that we contextualize our masterpieces against the background of their time. Here is my personal take on the Antitrust Paradox and its author:

People of my generation usually associate Bork with Reagan-style neoliberal laissez faire, and critics of the Chicago School denounce its alleged blind faith in the self-healing capacities of the free market. In hindsight, I think there is more to the Antitrust Paradox. The Wikipedia biography of Robert Bork suggests that he was a life-long warrior on several ideological battlefields, all of which somehow relate to the welfare and positioning of the United States in the global theatre as a healthy society and strong body politic. He was reportedly a supporter of a strong executive, quite the opposite of a libertarian. He did not, in my view, deserve the treatment that coined the term “to bork someone”.

There is something tense in his style, a sense of urgency, like in the recent U.N. Climate Report. I tend to believe that the urgency behind his thought was the Cold War, which was being fought on all fronts: militarily, culturally and economically. The CIA turned Jackson Pollock into the superior artistic representative of the free world in opposition to cheesy socialist realism. The economic front moved center stage after the Vietnam War was lost. The Antitrust Paradox was published three years after the evacuation of Saigon; it must already have been in the works at that point in time.

Whoever reads Ernest Mandel´s “Marxist Economic Theory”, first published in 1967 (German translation 1972 by Edition Suhrkamp), will be surprised by the emphasis on economies of scale and efficiencies. The higher the industry concentration, the greater the productive efficiencies. Reagan FTC appointee Terry Calvani once said he was happy with only two companies in any market. For the Soviets, even one is enough. If Jeffersonian small shop doctrine is “left”, and Hamilton/Bork/Friedman/Rand are “right”, the only economic school further to the “right” is Soviet economic doctrine. Another antitrust paradox. What if Bork was driven by the fear that the judicial support to small business doctrine, which prevailed in the contemporaneous antitrust policy, might deprive the United States of the super-efficient industry-based economy that was needed to compete economically in a politically duopolistic and fiercely competitive world? We may never know. However, we can still get high (a little) on the Antitrust Paradox. Maybe it is the most important book on antitrust ever written.

Dr. Bertold Bär-Bouyssière is Of Counsel in Dentons’ Berlin and Brussels offices. He has been involved in many important antitrust cases since 1995 and is an active member of the “EU Brussels bubble”. He served for several years as Co-Chair of AmCham’s EU Competition Policy Committee where he contributed with many others to the fruitful exchanges between DG COMP and industry stakeholders.

One thought on “Revisiting Bork the Antitrust Warrior”

Thanks for this great review, which I enjoyed reading a lot. I just would like to add one brief comment: The Antitrust Paradox was published three years after the evacuation of Saigon, so you are reasoning that it “must already have been in the works at that point in time.” In fact, while the book was published in 1978, it was written nearly a decade earlier. This was acknowledged by Bork himself at several occasions, I think including the introduction to the original volume.